The Bizarre World of Speculative TCGs

Last week the Dream Book TCG Kickstarter was brought to my attention.

It is one of the most bizarre Kickstarter funding charts that I’d seen. The campaign raised $185k in the first two days and has subsequently bled almost $10k a day in cancelled and reduced pledges.

What is especially strange is that most tabletop game Kickstarters have a U-shaped chart – that is strong early funding, a long trough, and a ramp into the final days of the campaign.

Typical U-shaped funding curve

This L-shaped chart is characteristic of what I am calling Speculative TCGs (trading card games). Or, collectible card games with some level (or a meaningful level) of funding driven by speculative buyers – i.e. backers motivated by potential price appreciation as a collectible, rather than pure gameplay.

There have been 18 trading card game Kickstarters that have raised over $100k (at least that I could find). 15 of these launched in the past 12 months. Average pledge per backer is an astronomical $455. And, 11 of these exhibit the unusual L-shaped funding chart.

This is a new-wave of trading card games whose success is driven in part by investor speculation, rather than organic play.

This is not an indictment of any individual project, or of the creators who made them. I would imagine that the game designers poured a lot of passion into these trading card games, and any of these games might be excellent (I haven’t played them).

Rather, this is an observation of consumer behavior around these new TCGs and product launches.

The Million Dollar Campaign – Meta Zoo

In February of this year (2022) a playing card Kickstarter made waves with a $1.9 million campaign - which is unheard of in the playing card space.

PlayingCardDecks.com did an excellent write up of the campaign.

Driving the astronomical funding was collectable cards for the TCG Meta Zoo that were included alongside the playing card decks.

It is impossible to know what portion of Meta Zoo backers participated in the campaign primarily for gameplay purposes, or as a speculative investment on the underlying cards.

However, it is clear that a portion of backers were speculative, and the creators of Meta Zoo focused a portion of their marketing into promoting Meta Zoo as a speculative investment.

It’s too soon to know if the game itself help, or hurt, or does it even matter? You know, it’s similar to Pokémon. You know, the majority of people don’t play Pokemon, but it’s the king of collectibles. - Rudy (Alpha Investments)

I can say this with confidence because they partnered with Alpha Investments - a controversial YouTube channel focused exclusively on the finance & investing side of trading card games.

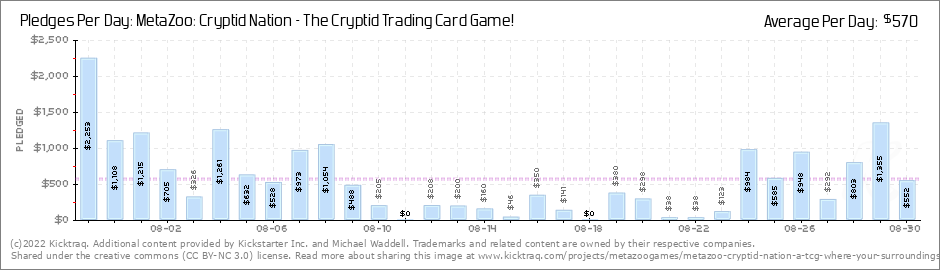

Meta Zoo’s playing cards campaign exhibited an L-shaped funding chart with negative funding late in the campaign.

Compare that to the initial game launch in 2020 which had a much more typical U-shaped funding curve.

Sorcery: Contested Realm TCG

This next campaign raised over $3.5m USD ($5.8m NZ). The campaign looks like it has a lot more going for it than just speculative buying. But, the publisher did partner with Alpha Investments.

They experienced a major spike in funding on 3-19 & 3-20 that coincides with the Alpha Investments video. So, conservatively, at least NZ $1m of funding is attributable to speculative buyers.

Note the more normal U-shaped funding curve

All that said, this campaign looks much more like a normal – and highly successful game launch.

It is clear that the creators put a lot of time and capital into top grade illustration (including a partnership with the Frank Frazetta estate), coupled with clean graphic design. The campaign and page is well thought out and focused on the game and illustration.

If I had the bandwidth for another TCG in my life, I would give Sorcery a try.

Flesh and Blood & a Global Pandemic

Early in the pandemic collectibles markets experienced massive price inflation driven by stimulus checks, crypto, and momentum. I had Magic cards that more than doubled in price in the course of six months (and we’re talking cards that were worth thousands of dollars pre-spike).

Flesh and Blood was a new TCG which launched in 2019. It received solid gameplay reviews, a growing player base, and was picked up by strategy sites like Channel Fireball.

I have friends who play, and friends who don’t play but bought sealed product on speculation.

Prices skyrocketed. First edition booster boxes were going for $1500 by November 2020, and upwards of $4k earlier this year. Prices have moderated slightly, with the most recent sales I could find at just over $3,000 for a first edition sealed box.

It is difficult to prove, but I believe there is a causal relationship between the rise of Flesh and Blood, and the new wave of high dollar TCG Kickstarters.

Flesh and Blood showed speculators that new TCGs can break out into a collectors market.

Things Have Changed

These are the 10 highest funding Kickstarter TCGs that launched prior to the past 12 months.

They were much more likely to have a normal U-shaped daily funding chart, and average pledge per backer was close to $100. In short, they look a lot more like regular tabletop games Kickstarters.

As Kickstarter Creators Should We Encourage Speculative Buying?

Value retention, or the idea that you can flip Kickstarter for a profit, has been a long-time justification for buying into board game Kickstarters – especially big box miniature games. I think this sentiment has been on the wane – there are more big box miniature games, and value on the follow is less certain.

The idea of creating an expectation (likely unspoken) of price appreciation is an interesting concept. If a game is successful enough, then the first edition printing, or Kickstarter exclusives, will likely appreciate, but that isn’t an expectation that creators generally foster or encourage.

TCGs are a special case due to supply-based rarity, and a natural secondary market for individual game pieces (that often won’t ever be printed again).

I think it would be hard but possible for a board game publisher to create an expectation of appreciation in a non-TCG campaign. It would involve a lot of exclusive content, and especially be powerful in an ecosystem where players play with their own game-pieces against one another.

I am fine with Kickstarter exclusives, and rewarding early supporters with differentiated product. But, leaning into speculative FOMO is not a strategy that I am interested in pursuing.

Finance & Speculation

Prior to publishing board games, I spent 13 years in finance, including 7 years as a front-line investment professional at a hedge fund. I am also an avid and long time Magic: The Gathering player and have about $50k in Mtg cards.

This is small fries for Mtg investors – because I don’t consider myself an investor.

I am a long-time player, who owns cards that I play with, and sealed product that I plan to play with. I’m also a beneficiary of the run up in TCG prices into and through the pandemic.

Floor vintage & Aperol spritz with my friend JR

All of this to say, that I am not completely clueless when it comes to either investing, or collectibles.

I am excited by the new wave of TCGs coming through Kickstarter. And, I am encouraged by the backer counts and funding levels.

I am especially encouraged as our next game Sigil, is a two-player dueling game that targets the same player demographics of TCGs and abstract strategy games (it’s Go meets Magic: The Gathering).

A couple of Sigil Spells

But, it is worth remembering that a lot of TCGs have come and gone over the years. I fondly remember playing the LOTR TCG, and the Star Wars TCG when I was in middle school – neither of which retained their value.

Most TCGs, including most TCGs in this new wave of Kickstarter TCGs will not retain long term value.

I would caution would be Kickstarter TCG backers who are there to make money - rather than enjoy a game - to be wary. There is a high likelihood that the product from any given campaign will lose value in the long run.

If you are a backer because you believe in the gameplay, that is amazing. If you are a backer because you hope to flip some product, have fun. If you have some extra cash and want to take a flier, that’s great. But, if you consider a TCG Kickstarter as a long-term investment, in my opinion, that is a pretty misguided strategy.

As an aside - I would also generally encourage people to be wary taking investment advice from people with vested interest.

Have you ever flipped a Kickstarter for a profit?