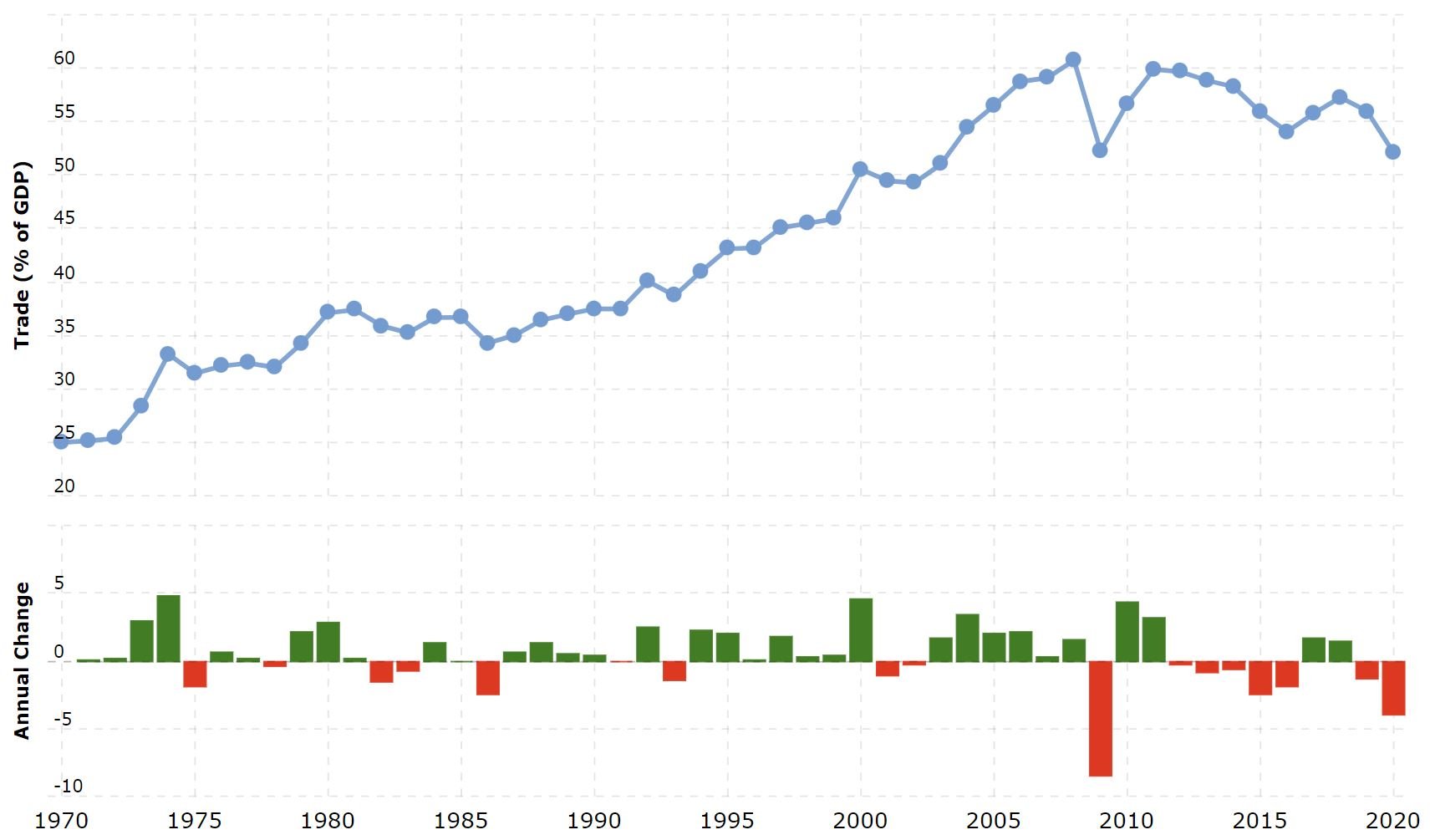

Freight is Normalizing

Freight prices are down 50+% from their peeks.

Yet, they remain over 3x their pre-pandemic levels.

Depending on who you talk to (or what articles you read), the global freight and fulfilment industries are experiencing a number of cyclical, as well as structural changes.

On the cyclical front are:

And potential long term structural trends:

I’m not an expert on global freight and fulfillment. But, I wanted to share some data-points that I’ve seen recently, and some articles and takeaways that I’ve read.

On the whole, I believe we’ve weathered most of COVID related freight volatility, and that there are some encouraging data points that freight pricing will continue to normalize.

Shipping Bottlenecks Abating

As of 08-29, there were only 7 ships waiting off-shore in the LA-Long Beach queue, “down from a record of 109 set in January and about 40 lined up a year ago”.

“The dwindling count reflects a slowdown in consumer demand, ample inventories built up by American companies, and ships rerouting through Gulf of Mexico and East Coast ports.”

The Numbers Don’t Lie

Freightios is the best free source I’ve found for historical trends in ocean freight prices. They recently put most of their indices behind a paywall, but still available are trailing 3-month data, and year over year trends. Here is China to US West & East Coast pricing year over year.

Below are actual quotes I pulled from Freightos for shipping pallets of Nut Hunt from Shanghai to New Jersey on 5/30 and 9/13.

While best available pricing is down 12% and 14% for 5 and 10 pallets respectively, encouragingly covers are tighter. That is, carriers are offering more similar pricing – which is a key indicator of reduced risk.

Because of this average pricing among the three most competitive bids are down 19% and 24% respectively.

There is Still Risk

If the pandemic taught us anything, it’s that our global supply chains are extremely fragile to disruption. While freight prices are moderating, there remains material risk of continued labor force disruptions, global macro and geopolitical risk, and potential inflationary pressure.

Looming in the near term are potential US rail strikes.

Where do you think freight prices will go from here?